About

Meet Fraser

Orr-Brown

I founded Approach Advisory with a mission to support business owners in making sound financial decisions that set them up for a secure future, without sacrificing their enjoyment of today.

My journey in the financial industry has been shaped by a diverse range of experiences that have honed my skills and deepened my passion for helping clients achieve their financial goals.

In my planning practice I walk clients through solutions that get them to retirement, despite the ever changing market.

Through collaboration with the portfolio management team at Cornerstone Fiduciary Wealth Management, we apply a process driven & cost-conscious investment approach that aligns with client risks.

My clients appreciate my ability to explain complex financial concepts in clear, understandable terms.

Before founding Approach Advisory, I served as a Financial Advisor at Raymond James Ltd. for over six years, where I developed comprehensive financial plans to help clients’ long-term stability and growth. Right out of university, I worked for a small accounting firm doing personal tax prep & corporate T2 prep while completing my professional diploma in Accounting and the CA Bridging Program.

My early career experiences provided a solid foundation in personal finance, retirement planning, & technical accounting.

These roles taught me the importance of compliance, strategic communication, and meticulous planning. Each step in my career has equipped me with the expertise and insight necessary to guide clients through their financial journeys, balancing today’s needs with tomorrow’s goals.

Education

Bachelor of Arts (B.A.): Commerce, Economics, Drama

Professional Diploma in Accounting

C.A. Bridging Program

Canadian Securities Institute

Exit Planning Institute

Certifications:

Why I Became a Wealth Advisor

Life is unpredictable.

This truth hit home early for me, shaping both my outlook on life and my career path.

Growing up, my mother struggled financially.

My father was diagnosed with MS shortly after I was born, and by the time I was two, he was in long-term care.

Without adequate insurance, my mother received no payout from his passing, and our family’s financial planning was far from ideal. We lived on a single income, & our lifestyle was restricted to the essentials, with little room for enjoyment or security.

Witnessing my mother’s financial struggles motivated me to enter the wealth advisory field.

I saw firsthand the importance of not just planning for the future but also ensuring that life is enjoyed today.

My father had big dreams and passions like scuba diving, getting a book he wrote published, and completing his schooling as a veterinarian – but his illness prevented him from fulfilling those aspirations. This taught me that while planning for tomorrow is crucial, living for today is equally important.

My goal is to help my clients strike a balance between securing their future and enjoying the present. I want to ensure that they don’t just work tirelessly with the hope of enjoying life later, only to have unforeseen circumstances disrupt those plans. By aligning financial strategies with personal values and goals, I aim to help business owners live fulfilling lives both now and in the future.

Planning wisely for tomorrow and living fully today – that’s the philosophy I bring to my practice.

The Approach Approach:

Balance

We believe in balance.

It’s possible to prepare for the future without sacrificing your life today.

"Fraser inspires me to financially manage my money better. He is very methodical & helps

me to plan better, budget and to reduce my expenses."

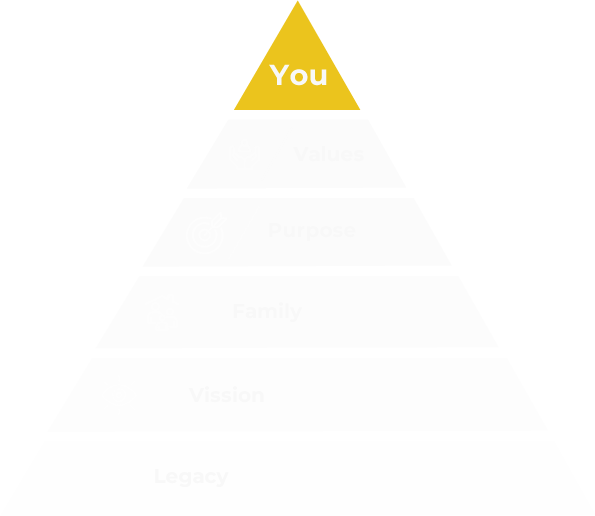

Everything starts

with YOU

Every client is unique. We tailor our advice and services to YOU.

What’s important to YOU?

What does a “good life” look like for YOU?

What are YOUR goals for retirement?

What does security look like for YOU?

What does success look like for YOU?

"We are grateful for your interest and understanding of our life position, and of our goals and dreams. It is a very special feeling to have a financial advisor

care very much about who we are as individuals."

Firms We work with

How We work

How We work

Your first step is a free consultation call to see if we’re a good fit to work together. Click the button to set up a time I’m looking forward to meeting you!