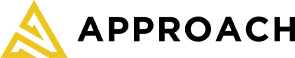

APPROACH360™

One relationship. Every financial decision covered.

You’ve built a successful professional practice. You earn well, but your financial life is fragmented: your investments live in one place, your accountant in another, your will is somewhere in a drawer, and you're wondering:

“Am I doing this right?”

Approach360™ is a comprehensive financial strategy designed for incorporated professionals earning $200K–$1M+ who want more than disconnected advice or DIY planning.

We bring your personal vision, corporate finances, investments, taxes, estate, insurance, and day-to-day money systems into one coordinated plan—so you can build wealth, reduce tax, and make confident decisions aligned with the life you want.

The Seven Pillars of Approach360™

Each pillar represents a key component of your full financial life—thoughtfully integrated and managed through an ongoing partnership.

1. Financial Life Visioning

We begin with an in-depth discovery process to understand what success looks like for you. Not just in financial terms, but in life. Through guided conversation and practical tools, we help you define:

What matters most to you and why you’re building wealth

Your short, medium, and long-term priorities

Personal values that should shape your financial decisions

The financial milestones that align with your purpose

This vision becomes the strategic foundation for every planning and investment decision we make together.

→ Clarify where you're headed and what you're building your financial life to support.

2. Entity & Account Structure

Your corporation is more than a tax shelter and filing obligation. It’s a core piece of your wealth-building strategy. We review and optimize your entire financial structure, including:

Corporate and personal account setup

Use of IPPs, RCAs, RRSPs, TFSAs, and trusts

Holding companies and inter-entity transfers

Legal structuring for long-term tax efficiency and risk mitigation

We ensure that your financial architecture supports your goals and works seamlessly across all areas of your life.

→ Build a rock-solid foundation for tax-efficient, long-term wealth creation.

3. Tax Strategy & Income Design

How you pay yourself matters—both now and later. We create a personalized tax plan to:

Optimize your salary/dividend mix

Use income splitting and spousal loan strategies

Plan for future withdrawals and pension-style income

Minimize overall tax burden while maximizing cash flow

Whether you’re drawing $200K or $800K, we help you keep more of it—and use it wisely.

→ Stop overpaying tax and start using your corp strategically.

4. Portfolio Management & Oversight*

We manage your portfolio* across personal and corporate accounts to match your goals, risk profile, and tax profile, amongst other considerations. But we don’t stop at portfolio design—we also help you:

Stay the course through market volatility

Avoid reactionary decisions based on hype or fear

Understand how your portfolio works in the context of your full plan

*Portfolio Management products and services are provided by Cornerstone Fiduciary Wealth Management

We act as both strategist and accountability partner, helping you grow your wealth intentionally—and sustainably.

→ Invest with clarity, consistency, and confidence.

5. Risk, Estate & Legal Protection

We help ensure that your legal and insurance protections align with your overall strategy. That includes:

Wills, cohabitation/marriage agreements, POAs, personal directives

Shareholder and buy/sell agreements

Life, disability, and critical illness insurance

Estate and charitable planning

You don’t just get referrals—we schedule meetings, follow up, and ensure execution. You stay protected without managing the admin.

→ Safeguard what you’ve built and remove future stress for your family.

6. Bookkeeping, Accounting & Admin

We make sure your financial backend is seamless and handled. Services include:

Monthly bookkeeping for your corporation

Year-end filings (via CPA partner)

Setup and integration of accounting software

Real-time financial dashboards

Clean document management and digital storage

No more shoeboxes. No more tax-time surprises. Just clean data, handled on your behalf.

→ Run your professional corp like a pro—with zero hassle.

7. Lifestyle & Freedom Planning

This is where strategy meets possibility. We explore how your financial plan can support meaningful lifestyle changes—whether that’s stepping back from work, shifting to part-time, taking a sabbatical, or pivoting to something new.

Deliverables include:

Custom “what-if” scenario modeling (e.g., working less, spending more time with family, launching a passion project)

Analysis of how much income you truly need to support your preferred lifestyle

Contingency planning to maintain financial security while increasing flexibility

You don’t have to wait until “retirement” to live well. We help you design a financial plan that supports the life you want to live now.

→ Create financial space to choose how you spend your time, energy, and focus.

What You Can Expect

One point of contact who sees the full picture

Clear deliverables across all seven service areas

Ongoing support, reviews, and plan updates

Coordination with your accountant, lawyer, and other professionals

Confidence that nothing important is falling through the cracks

This isn’t traditional financial advice.

It’s not just retirement planning, accounting, tax strategy, or investment management.

It’s all of it. Delivered in a way that aligns your money with your values.

Your first step is a free consultation call to see if we’re a good fit to work together. Click the button to set up a time I’m looking forward to meeting you!