IPP & RCA

CANADA'S BEST-KEPT

TAX SAVING SECRET

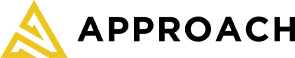

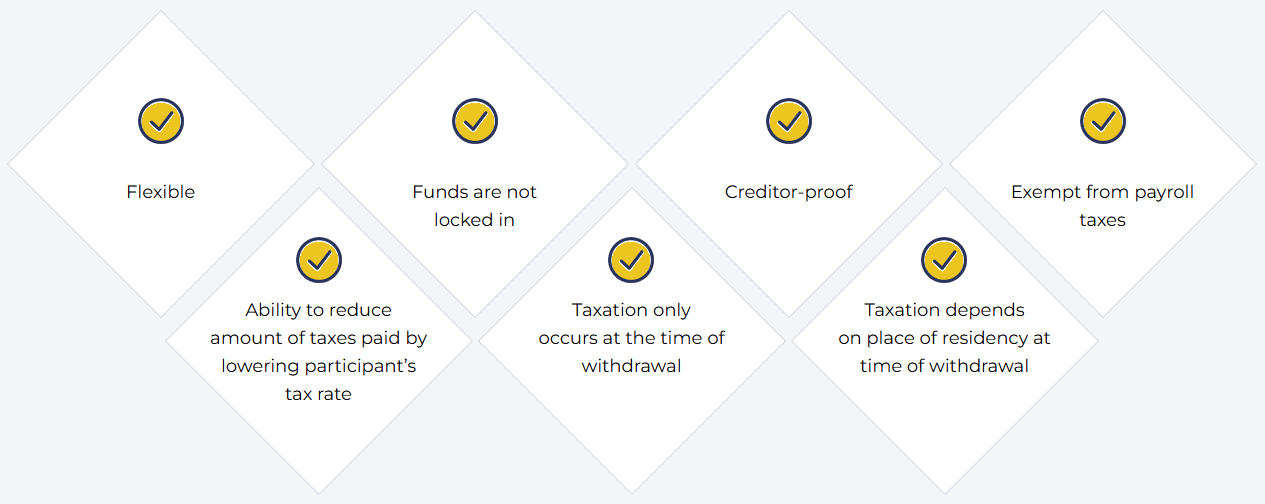

Put an extra $1M aside in a tax deferred, creditor proof vehicle

Take the money you would have paid in taxes and set yourself up for a comfortable retirement instead

IPP & RCA

Save taxes now and build a nest egg for the future with IPP and RCA pension plans for owners. Canada’s best kept secret!

Your first step is a free consultation call to see if we’re a good fit to work together. Click the button to set up a time I’m looking forward to meeting you!